- WIADOMOŚCI

- WYWIADY

Will Europe's semiconductor industry keep lagging behind

The European Union faces a stark and unavoidable truth: its security and strategic autonomy can no longer depend solely on allies across the Atlantic. Faced with an increasingly transactional United States, a resurgent and aggressive Russia, and China’s push for technological dominance, the EU must reckon with a simple reality—true sovereignty begins with the capacity to defend itself.

Photo. mika mamy/Pixabay

Author: Sébastien Gobert is a French freelance journalist based in Ukraine.

Recent comments by the new U.S. Defense Secretary should serve as a stark warning to the European Union. If the Trump administration continues its isolationist trajectory, the old-world order may give way to a new era marked by fragmentation, instability, and economic turmoil. As Europe struggles to face off Russia’s full-scale invasion of neighbouring Ukraine, it is obvious it can no longer rely on traditional power structures. instead, it must redefine its geopolitical strategy. This means shifting away from a model rooted in global neoliberal institutionalism and toward one anchored in robust national and continental alliances that should be forged and led from Brussels. The very concept of sovereignty is at the heart of transnational debates today.

Sovereignty in defence

Defence sovereignty is perhaps the most significant. It is no longer just about troops and tanks… In the 21st century, it is rooted in economic resilience, supply chain control, and above all, technological independence. High-performance semiconductors, artificial intelligence, and supercomputing infrastructure are not just tools of economic competitiveness; they are the bedrock of national and regional defence capability. Without mastery over these, Europe risks becoming a spectator in conflicts where it should be a player. Companies like Thales Group and Rheinmetall lead European defence production, but for longevity further investment is required across the board.

Indeed, Rheinmetall is currently rethinking its approach to a more Euro-centric defence strategy and has enjoyed strong growth over the last two years, a direct result of the GermanZeitenwende and European anxiety about the Russian threat in the east. Swedish firm Saab is building a high quality aeronautics industry, with its Gripen C/D proving particularly popular and highlighting the potential of European industrial innovation.

All this underlines how, in fact, Europe does not lack talent or industrial strength in defence. Countries such as France, Germany, and Sweden are home to globally respected defence manufacturers and R&D institutions. The continent produces submarines, aircraft, and missile systems that are among the best in the world. But this strength is fragmented. As an article inThe Parliament Magazine notes, efforts to improve EU military mobility have been slowed by excessive bureaucracy and underinvestment, undermining Europe’s capacity to respond swiftly to crises or to project coordinated power. This has meant Europe has been slow to develop sectors like AI and quantum computing.”Quantum has the potential to transform many sectors: medicine, energy, computing and communications, climate and weather modelling, cybersecurity, space, defence and more,” said Thomas Skordas, deputy director general for DG Connect in the Commission.”It will enable huge productivity gains, revitalise industry, and open up new markets, applications and job opportunities.”

$$

Meanwhile, transatlantic relations—long a cornerstone of European security—are showing signs of strain. Washington has long demonstrated increasing willingness to interfere in European defence exports - one needs not to remind of the France vs. AUKUS crisis. Yet U.S. protectionism has become a systematic policy under President Trump. A most recent example is the U.S. pressure on Colombia to drop a deal for Swedish-made Saab Gripen jets, choosing instead an American alternative. This interference is more than yet another diplomatic frustration; it reveals Europe’s vulnerability when it lacks independent defence and technological pathways.

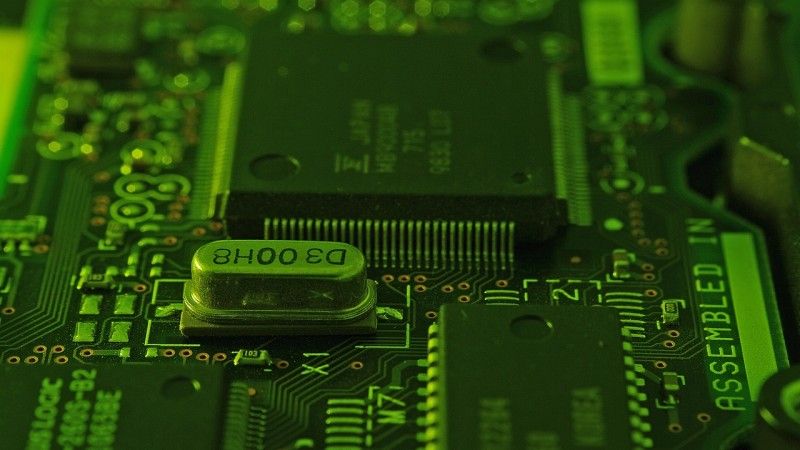

European vulnerability in tech

This vulnerability extends deeply into the realm of semiconductors and AI—two areas in which Europe remains highly dependent on U.S. and Asian technologies, in spite of the introduction of the European Chips Act designed to reduce this reliance. These technologies power everything from battlefield communication systems to missile targeting, autonomous drones, and cyber-defence networks. Simply put, there can be no true European defence capability without sovereign microchip production and AI infrastructure. Indeed as Roberto Viola, Director General of DG CONNECT, states: The potential is immense, and Europe cannot afford to miss this opportunity. ”

The United States understands this well. Its Chips and Science Act allocated $52 billion to re-shore semiconductor production, and companies like Nvidia and other chipmakers have received tens of billions in federal support to maintain their lead in AI and GPU development. By contrast, Europe has only recently begun to acknowledge the scale of the challenge. The aforementioned European Chips Act, launched with a proposed €43 billion in public and private investments, is a step in the right direction—but still lags far behind the ambition shown by global competitors.

Startup promise

The well-known Infineon Technologies company develops chips for use in defence applications like radar and communications systems. Yet for Europe to consecrate long term sovereignty, the more semiconductor developers the merrier.”Our aim is to give Europe and all our users greater sovereignty, particularly in relation to the United States while building a leading position in the global application markets of artificial intelligence and supercomputers,” SiPearl CEO Philippe Notton says. SiPearl is a French company and participant in the European Processor Initiative. The company claims its Rhea1 chip is one of the continent’s first high-performance, low-power microprocessors tailored for supercomputing and AI—two key enablers of modern defence systems. This kind of technology is designed to power applications in energy, climate modelling, biomedical research, and, crucially, defence.

SiPearl is only one of the examples of the challenges at stake since it has to compete with giants like Nvidia, Intel, and AMD that benefit not only from vast markets but also from government subsidies and favourable export regimes. If Europe wants young companies like SiPearl to survive—and to thrive—it must provide the political and financial backing needed to scale. Otherwise, Europe will once again find itself relying on foreign technologies at moments when its strategic independence is essential. One expects from EU leadership to create an ecosystem in which companies may be backed up by a host of very high-level players in a variety of fields such as AI accelerators. A whole infrastructure needs to be put in place as quickly as possible to ensure genuine independence at European level.

The recent European Defence Industrial Strategy released by the European Commission recognizes this urgency. It outlines a framework for boosting defence production capacities, simplifying procurement, and reinforcing Europe’s defence industrial base. The strategy is clear: a technologically autonomous Europe must support its own champions, especially in fields as strategic as AI and semiconductors.

Will the EU step up?*

The EU has also proposed allowing member states to use central EU budget funds to reinforce defence readiness, a move that signals a shift from symbolic gestures toward meaningful financial intervention. If passed, this could open new pathways for funding defence-related technological development.

These steps come at a critical time. Beyond military implications, the geopolitical competition for technological dominance is reshaping the global economic order. Chips and AI systems are becoming the oil and steel of the 21st century—resources that determine not just prosperity, but survival. Whoever controls these tools will shape the rules of engagement, both in commerce and in conflict.

At the same time, China and the United States are doubling down. The recent surge in Chinese AI patents and breakthroughs in quantum computing shows a country determined to lead. Meanwhile, the U.S. has become more assertive in using technology export controls as a geopolitical tool. From restrictions on advanced chip sales to China, to controlling where European-made chips can be sold if they use U.S. technology, the message is clear: technology is power—and it will be wielded accordingly.

For Europe, the path forward is not to copy U.S. or Chinese industrial policies, but to build one tailored to its strengths and values. The EU can leverage its internal market, research networks, and democratic governance to support a competitive, sovereign technological base. But it must act with greater urgency and coordination. Its success will depend on whether EU institutions, national governments, and private investors are willing to back it at scale, with long-term vision and strategic patience. Europe is not starting from scratch and it is fortunate to have a number of start-ups capable of replacing American solutions in the field of applications and operation systems (OS). Europe can – and must – act to reclaim control over its digital future as explained in the latest Eurostack report.

The stakes could not be higher. If Europe wants to remain a global actor with the power to defend its interests, protect its citizens, and shape its destiny, it must invest in the technologies that make sovereignty possible. That means faster decisions, bigger investments, and stronger political will.

In the end, defence sovereignty is not just about protecting borders—it is about ensuring that Europe has the tools to make its own choices, free from coercion, in a world where power is increasingly wielded through technology. The time to act is now. The cost of inaction may be measured not only in economic decline but in lost autonomy and diminished global relevance.