- KOMENTARZ

- WIADOMOŚCI

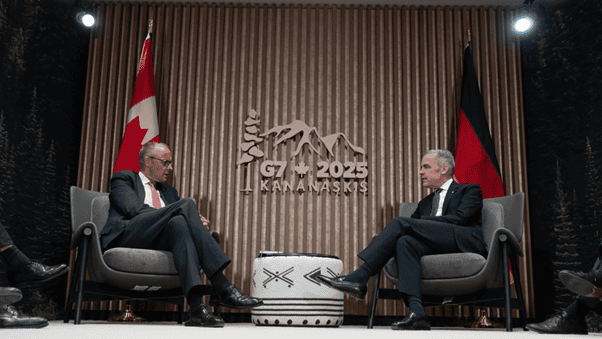

Chancellor Merz as “Europe’s Mark Carney”? A flawed parallel

Some hail Chancellor Merz as “Europe’s Mark Carney” amid global tension. Yet, while the headline appeals, the comparison oversimplifies the reality.

Following Justin Trudeau’s departure, Mark Carney steered the struggling Canadian Liberals back to power in 2025, securing a mandate defined by Ottawa’s battle against punitive U.S. tariffs. Speaking at Davos in January, he described the international order as suffering a „rupture” and urged middle powers to form coalitions focused on specific, shared issues.

German Chancellor Merz echoed similar sentiments at the recent Munich Security Conference, emphasizing the necessity of transatlantic trust and cautioning against the rising tide of protectionism. Despite these rhetorical similarities, the political realities for the two leaders differ significantly.

Chancellor Merz operates from a considerably weaker domestic position. He required a second Bundestag ballot to secure the chancellorship in 2025, and his governing coalition of the CDU/CSU and SPD remains visibly divided, especially over labor reforms and welfare policy. Public sentiment reflects this fragility, with the recent ARD-Deutschlandtrend polling indicating that only 21% of voters are satisfied with the government and just 25% approve of Merz’s performance.

Economic pressures weigh heavily on this fragile political footing. A 15% U.S. tariff now affects the majority of EU goods, which contributed to a 12.9% year-on-year decline in German exports to the United States in December. Broader EU exports to the U.S. saw a similar drop of 12.6%, while the trade deficit with China continued to widen.

The energy and industrial sectors face specific hurdles that further complicate the economic picture. Although Germany’s gas supply is more secure than during the 2022 crisis because of diversified imports and increased LNG shipments, European industrial power prices remain stubbornly high. With costs sitting at more than double those in the U.S. and China, the automotive industry illustrates the severity of the struggle. Chinese brands doubled their European market share to 6% in 2025, a shift that prompted Germany’s automotive industry association to warn of the risk of investments and jobs moving overseas.

Finally, Germany faces a constraint that Canada does not. Berlin must navigate its policy objectives through complex EU negotiations, a reality that has fueled German advocacy for „two-speed” approaches within the bloc. While Merz may speak the language of a global standard-bearer, the comparison to Carney currently appears to be aspirational branding rather than a practical blueprint. For now, the label simply outpaces the tangible outcomes.