- WIADOMOŚCI

- WYWIADY

Why the EU hesitates to seize Russia’s fozen funds

What primarily prevents the European Union from using frozen Russian state assets?

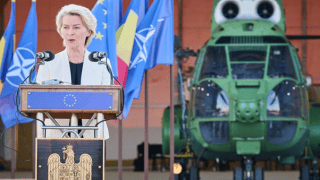

Photo. Twitter (X) / @vonderleyen

Michał Górski, Defence24: On Monday, several European Union countries (including Poland) issued an urgent appeal to the European Commission and the European Council regarding the need to use frozen Russian assets for Ukraine’s benefit (as a reparations loan). Is this truly something Europe should do as soon as possible?

Dr. Adam Eberhardt, University of Warsaw: For several months now, the United States has not been co-financing Ukraine’s defense effort. The financial burden of this war has fallen on European countries. That does not mean the U.S. has completely withdrawn its support for Ukraine. It continues to provide intelligence, Patriot missiles, and other types of weaponry that Europe is unable to supply. All of this must be financed with European funds. Therefore, within the European Union, mechanisms are being sought to secure tens of billions of euros over the coming months. The obvious way to obtain these funds would be to seize the €180 billion in Russian assets that were frozen in European banks in 2022. This amount would allow the financing of Ukraine’s defense for roughly two years.

The search for these mechanisms has been ongoing for quite some time…

The discussion about seizing these assets has been underway for many months. It is a difficult conversation, given the potential legal consequences for Europe’s credibility as a financial market. For this reason, there is a clear reluctance to take action. The European Central Bank has refused to act as a guarantor for a loan that would be secured by Russian assets frozen in Europe.

In the debate over frozen Russian assets, two countries have recently played a particularly important role — Belgium and the United States.

Belgium maintains its opposition. Its prime minister believes that unfreezing the assets and using them for Ukraine carries certain political and financial risks for Belgium as the guarantor state. Most of the assets are held by Euroclear, which is based in Brussels, Belgium.

The United States is also not particularly enthusiastic about European countries financing Ukraine’s defense effort using Russian funds. I think this is connected to various offers that have surfaced during the talks between Witkoff and Kushner in Moscow, where the Russians are trying to entice people close to President Trump with business deals that, I believe, are also intended to eventually make use of unfrozen Russian assets. I would interpret these Russian actions as an attempt to counter a scenario that Moscow sees as disastrous and utterly unacceptable.

What could be the concrete consequences of using these funds?

First, it would undermine the EU’s credibility as one of the world’s leading providers of such financial services. This could lead many potential clients to choose to keep their funds outside Europe, for example, in the Gulf states.

The second issue concerns the consequences of a deep, long-term Russia–EU conflict. The seizure of Russian foreign currency reserves would eliminate any prospects for a future reset between the Union and Russia for many years to come. Many politicians in Western Europe would prefer to avoid this, hoping that after the active phase of the war ends, there will be an opportunity to normalize relations between Russia and the West.

What is likely to happen in the coming days? Will the EU take this step, or will the desire for a reset prevail?

At this stage, I think the fear of the consequences of such a radical move outweighs the desire for a reset. I believe we will see various forms of creative accounting within the EU — attempts to issue bonds to support Ukraine in a way that uses Russian assets indirectly, without doing so overtly, and postponing the final decision on seizing the assets until a later time.

In early December, Vladimir Putin warned that Russia was ready for war with a hostile Europe. At the same time, advanced talks were underway on seizing €185 billion in frozen Russian reserves. Can these two things be connected?

Yes, this confirms that the Russians are trying by all possible means to discourage Europe, demonstrating the potential consequences of escalating tensions between Russia and European countries.

Thank you for the conversation.